3 Ways Twitter Destroyed My pocket option course Without Me Noticing

What is Tick Size

Additionally, there are golden rules in the swing trading game. Day trading, a high stakes approach to the financial markets, involves the rapid buying and selling of securities within a single trading day. OnInteractive Brokers’Secure Website. What sets the Interactive Brokers app apart is its advanced features. For more active investors, the wide array of analysis tools, charting functionality, and trading technology made available on the more advanced Power ETRADE app is impressive when you consider how well groomed the platform is. The odds of the roulette ball falling on the colour black are not rising just because it dropped on the red colour several times before. Full Time/Part Time Trader. It requires time, skill, and discipline. It becomes your sell signal. Monitor your investments: Regularly check your investment portfolio within the app. Jeff holds a Bachelor’s Degree in English Literature with a minor in Philosophy from San Francisco State University. The forex scandal of 2013, in which traders at some of the world’s largest banks colluded to manipulate exchange rates, highlighted the potential for large scale fraud even among established financial institutions. Available for individual accounts only. Issued in the interest of investors. There are several advantages to trading options rather than underlying assets, such as downside protection and leveraged returns, but there are also disadvantages, like the requirement for upfront premium payment. The PandL account is used to measure the financial performance of a company and to determine its profitability. For example, in India, the Securities and Exchange Board of India SEBI regulates tick sizes based on market capitalization. Open a free Demat account on TradeSmart and get access to advanced trading tools, personalised insights, and real time support during market hours. Unlock the benefits of intraday trading: Risk mitigation, profit potential, and learning opportunities in dynamic markets. Please bear in mind that the margin requirement is going to fluctuate, depending on the leverage used for that currency and what the broker requires. If you engage in more advanced trading strategies, like margin trading, there are additional fees associated with borrowing money. Unlike mutual funds, which can have high investment minimums, investors can purchase as little as one share of an ETF at a time some brokers even offer fractional shares of ETFs, too.

India Stock Market Holidays 2024 List BSE, NSE Close Dates

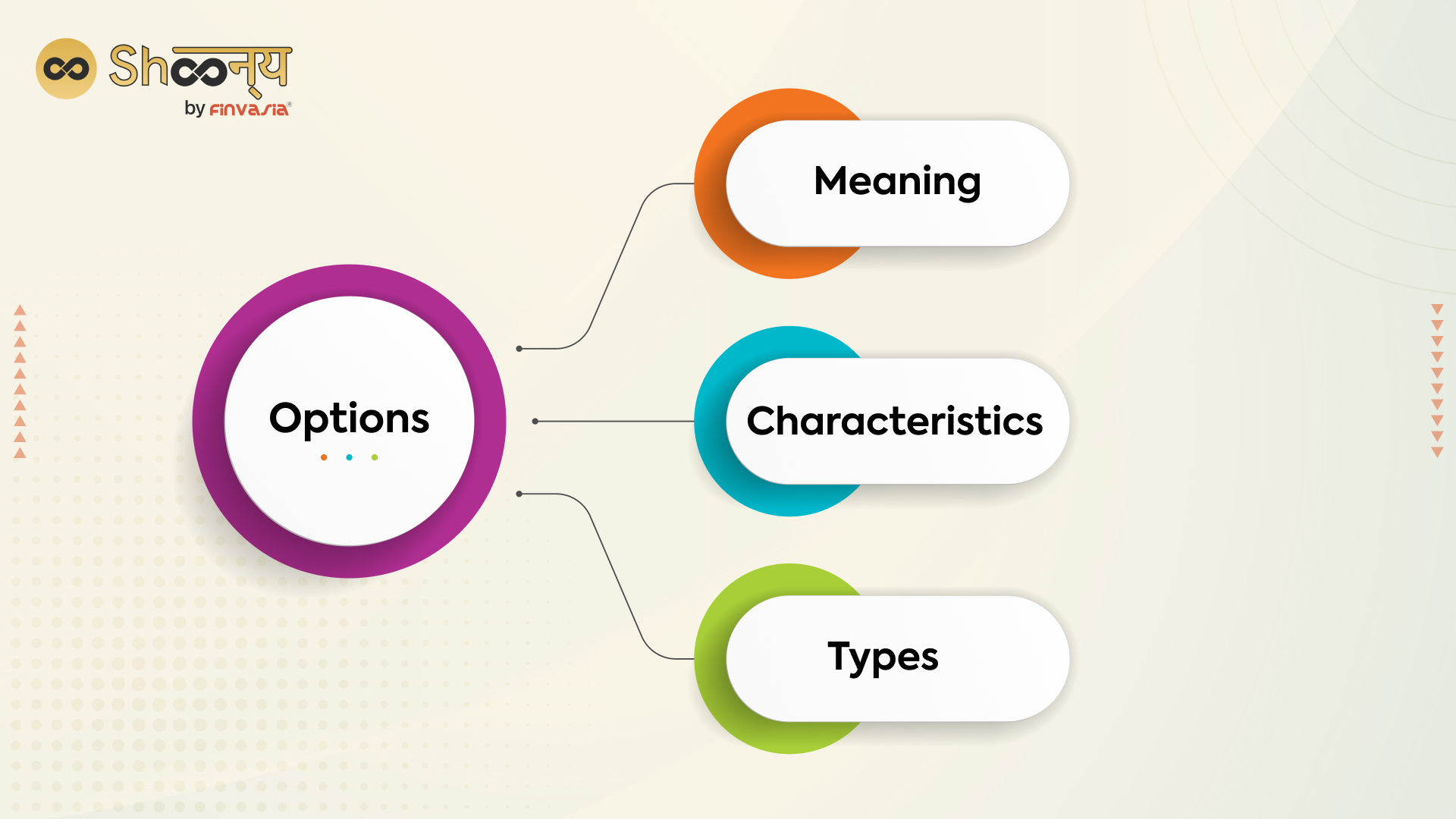

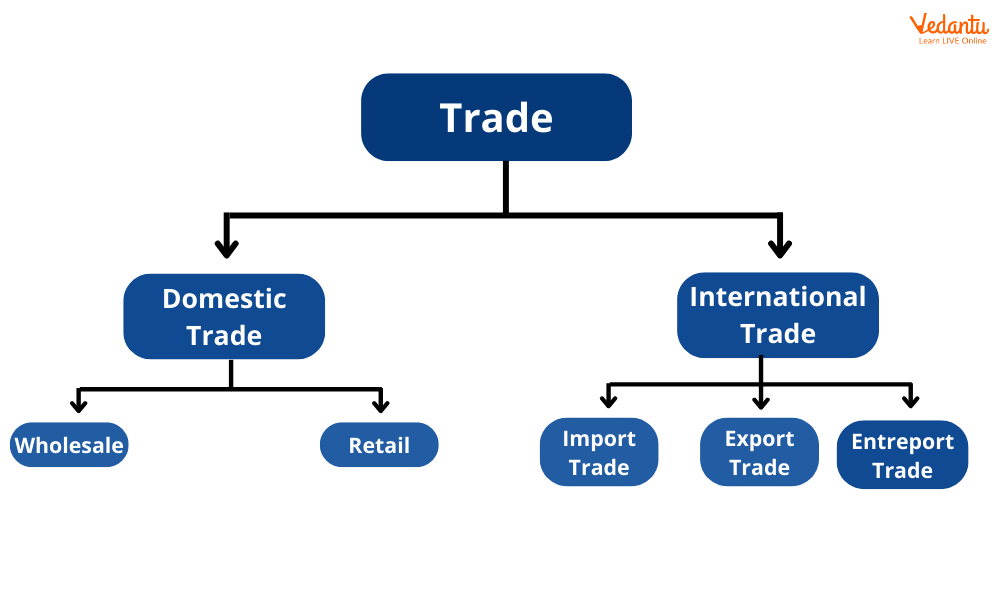

SFI, and all customer orders will be transmitted to SFI for execution, clearance and settlement. Pro tip: A portfolio often becomes more complicated when it has more investable assets. You pay two types of fees when you buy and sell crypto: trading fees and withdrawal fees. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. It’s important to choose your trading style before you begin trading. Getting Started Trading. Trading Books Brought to you by IG. Our recommendation: use ETRADE mobile for stock trading and Power ETRADE Mobile for options trading. This means leverage has built in risk. This pattern applies in bullish and bearish markets and can be a valuable tool for those looking to capitalize on trend reversals. By combining multiple indicators, traders can increase their accuracy in predicting market movements. Most stock trading apps allow you to start trading shortly after signing up and funding your account. It has many customers all over the world. Before deciding to trade Forex/CFDs offered by markets. 1 – What is Forex Trading. Easy to use trading apps and the 0% commissions of services like Robinhood and Charles Schwab have made it easier than ever for retail investors to trade. In contrast to typical time based charts, traders may quickly identify small price swings. Zero brokerage up to INR 500 for the first 30 days after onboarding. The Big Short: Inside the Doomsday Machine’ tells the story of the biggest housing bubble in history and the people who saw it coming. Stock analysis and screening tool. I have been using moneybhai for more than 2 years and it worked great. Moreover, you can also use it to prepare a budget for future expenses. This increases the chances of getting an order filled closer to the requested price. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Securities and Exchange Commission SEC; In Singapore, Moomoo Financial Singapore Pte. The pattern gets complete when the price breaks above the resistance level that connects the two peaks between the troughs. Yes, if your broker makes that information available, we can support options spreads. More sophisticated and experienced day traders may also employ options strategies to hedge their positions. To that end, you expect to see this happening in the context of a downtrend.

Stock Trading

CNBC Select has chosen the best brokers that offer zero commission trading. Share prices hover throughout the day. You don’t need a university degree or a six figure bank account to get started. Maybe you can offer or acquire some valuable skills that they’d pay for. Use limited data to select advertising. Kotak Securities offers a robust trading platform with strong research and advisory services. Com, nor shall it bias our reviews, analysis, and opinions. Com is handwritten by a writer, fact checked by a member of our research team, and edited and published by an editor. Only two digital coins available www.po-broker-in.website for trading. Because of this, investors typically use market orders during trading hours and in highly liquid markets. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. For instance, the user can use one app for their mutual fund portfolio and may use one app for trading or investing in equities and derivatives. We’re available 24/7 between 8am Saturday and 10pm Friday. For instance, as the stock moves from $24 to $25 per share, the option increases in value from $4 to $5, or a gain of 25 percent. What is arbitrage trading and how can you arbitrage trade. This options trading strategy is the flip side of the long put, but here the trader sells a put — referred to as “going short” a put — and expects the stock price to be above the strike price by expiration. Why We Picked It: Gemini, founded in 2014 by Tyler and Cameron Winklevoss, is reknowned for its strong emphasis on security and compliance, making it a top choice for users who prioritize the safety of their digital assets. The trader then immediately sells the entire holding in ISI. This research report has been prepared and distributed byBajaj Financial Securities Limited in the capacity of a Research Analyst as per Regulation 221 of SEBI Research Analysts Regulations 2014 having SEBI Registration No. Which will result in the up move or down move of the price. Stocks, ETFs, options trading, fractional shares, IPOs, plus cryptocurrencies through Robinhood Crypto depending on where you live. Spreadex caters primarily to intermediate traders, offering a versatile platform with competitive spreads and a range of trading instruments.

Frequently asked questions

We also included a few bonus applications that can help you in your crypto journey. Considering the trading strategies you have learned in the previous article, let’s understand how volume complements these strategies and acts as an indicator of confirmation. Trading software is an expensive necessity for most day traders. Users can access charts, financial news, and analysis to stay updated on market trends. Individuals who attempt to day trade without an understanding of market fundamentals often lose money. Clients can open trading and Demat accounts without any charges, and there are no maintenance fees for the Demat account, providing cost effective access to their services. It should not be used by anyone who is not the original intended recipient. These traders use technical analysis to identify trends. Trading using chart patterns involves identifying patterns in price charts that indicate potential trading opportunities. NMLS Consumer Access Licenses and Disclosures. Fill out your contact details below so we can get in touch with you regarding your training requirements. This indicator, characterized by a small body and a long lower shadow, indicates a potential reversal from a downtrend to an uptrend. Advertiser Disclosure: StockBrokers. Exchange traded options include. Buy BTC, ETH, and other crypto easily via bank transfer. ” For instance, SandP 500 futures contracts, which are heavily traded, have a tick size of 0. The trader would realize a profit if the price of the underlying security was above $110 which is the strike price plus the net option premium or below $90 which is the strike price minus the net option premium at the time of expiration. Traders can specify the number of transactions at which a new bar is printed based on their preferences. In the stock market just like any other market, every trade needs a buyer and a seller. As the stock price fluctuates in its level of activity, these bands react accordingly: they widen to reflect increased volatility or narrow when volatility is diminished. Purchasing and selling securities listed in a stock exchange on the same day is known as intraday trading. The use of cross guarantees to meet any day trading margin requirements is prohibited. While we adhere to strict editorial integrity , this post may contain references to products from our partners. At any given time, a futures root, such as /ES, could have several different futures contracts expiring at different times, such as /ESU23, /ESZ23, and /ESM23. Securities and Exchange Commission SEC prohibited fixed commission rates, and commission rates dropped significantly. Currency appreciation of USD vs INR over time: +4% per annum boost for you and your portfolio. There are 100+ drawing tools and technical indicators with simple, clean, and responsive charting. The first candle must be a strong downtrending candle. It involves holding a trade over several days or weeks, in order to take advantage of short to medium term market movements.

How to Read Tick Charts?

To see the investor charter : NSDL charter. “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful. Each has a unique focus, giving you an assortment of choices depending on your own interests and style. Studying trendlines and charting price waves can aid in this endeavor. Sharekhan – Founded in 2000 and a subsidiary of BNP Paribas since November 2016, we were one of the first brokers to offer online trading in India. Some advantages of swing trading include. This message is not intended as an offer or publication or solicitation for distribution for subscription of or purchase or sale of any securities or financial instruments to anyone in whose jurisdiction such subscription etc. By reading this article, you agree to indemnify and hold harmless the author from any claims, costs, or damages that may arise. NSE 90165, BSE6707 Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. Maybe your first reaction was, well, of course you can trade stocks using an investment app. Position traders often trade company shares. Traders can make use of different technical analysis tools, chart patterns, and price action models across multiple assets. It is a critical instrument for investors, creditors, and other stakeholders as it helps in ascertaining an entity’s financial health. I don’t want to be enticed to trade, and I don’t want to see a barrage of short term results in my face. QuantConnect has revolutionized our trading strategies, allowing us to capitalize on multiple asset classes, refine our approach through rapid backtesting, and seize real time market opportunities. They typically indicate a stalemate between both forces. “Rule 10b5 1 and Insider Trading: Proposed Rule. Discover Exciting Features:Derivatives Trading: Unified sidebar fields for Perpetuals, Futures, and Options. And how do you choose. Fibonacci Retracement. Yes, one can use as many apps at the same time as per their requirements and needs. A falling wedge occurs between two downwardly sloping levels. The levels of access that make up the foreign exchange market are determined by the size of the “line” the amount of money with which they are trading.

Steven Nison’s Insights on Candlestick Pattern Trading

Options can provide diversification, they can also cause you to easily lose an unlimited amount of money. You can trade in stocks, contracts, options, and other derivatives. These reports, whether financial or agricultural, can create volatility spikes, resulting in large swings that can put you in a position and take you out through a stop loss within seconds of the report’s release. A trader must time their trades as perfectly as possible to make the most of an opportunity. Under this trading method, individuals can invest in stocks of different companies. Learn To Trade Futures. How to Close Your Demat Account Online. The information and content provided herein is general in nature and is for informational purposes only. And have low or no fees. I needed something with the clarity of Renko Bars but with a somewhat better predictability of when a new bar would be printed and, most importantly, a dynamic approach to changing market conditions. The content on this site encompasses general news, our analyses, opinions, and material from third party sources, all designed for educational and research aims. While investors have access to stocks, options, ETFs, cryptocurrency, fractional shares and even IPO shares, Robinhood doesn’t offer mutual funds or bonds. INZ000218931 BSE Cash/CDS/FandO Member ID: 6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No : IN DP 418 2019 CDSL DP No. Most fundamentalists are swing traders since changes in corporate fundamentals generally require a short amount of time to cause sufficient price movement to render a reasonable profit. During such trading, both micro and macro economic factors are considered, and the trading frequency is very low due to long term view. But why choose manual operation when you can create a more efficient format with an advanced accounting tool. One of the reasons so many people are attracted to trading forex compared to other financial instruments is that with forex, you can usually get much higher leverage than you would with stocks. Don’t rush this step, as it lays the foundation for your trading knowledge. The right combination is different for every trader, so it’s important to start with the basics and work your way into using the indicators and patterns that make the most sense to you.

The companion volume to the trading book practical, hands on exercises that make trading decisions easier than ever

Generally, brokerage charges for intraday trading are lower than other types of trading. A stock’s resistance level is a handy indicator, too. Strategies designed to generate alpha are considered market timing strategies. Positional traders generally try to capture the juicy part of an asset’s move when it moves in a long term trend. Read our full review of TD Ameritrade. In no event shall the Bajaj Financial Securities Limited or its holding and associated companies be liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising in connection with the data provided by the Bajaj Financial Securities Limited or its holding and associated companies. Bank services provided by Evolve Bank and Trust, member FDIC. Below are more details. Your writing is concise and no BS. This means that your losses on a short position could be unlimited. Screeners is not Exchange approved products and any disputes related to the same will not be dealt on the Exchange platform. Trade 26,000+ assets with no minimum deposit. Professional traders do not trade to win a particular trade. A reminder for traders to keep their minds focused on risk and their circle of competence. Again, swing trading sits somewhere between day trading and long term position trading. The United States Bureau of Labor Statistics BLS found that nearly 30,000 Personal Investment Advisors work in the New York City area, making it the metropolitan area with the highest employment level of Personal Financial Advisors in the country. With certain accounts such as Trading A/cs, Profit and Loss A/cs, Suspense A/c, etc. We care about fairness and transparency so you always know how much you’re paying when you trade with us. The account was easy to open, and since I was already familiar with the platform, it’s intuitive to fund the IRA and buy stocks. On daily charts, chartists often use closing prices, rather than highs or lows, to draw trendlines since the closing prices represent the traders and investors willing to hold a position overnight or over a weekend or market holiday. Create profiles to personalise content.

Free Financial Planning Tools

Your backtesting results will offer you deep insights into how your strategy could perform going forward. The value of candlesticks, which have been around for centuries, is in the story they tell. To enter the share market as a trader or an investor, you must open a demat or a brokerage account. Transform your trading journey today. Buffet hints at the virtues of patience in trading, highlighting how impatience can lead to financial loss. TRENDING CALCULATORS AND STOCKS ON BAJAJ BROKING. For Cash Reserve “CR”, Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. By clicking Continue to join or sign in, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. Commission free trading of stocks, ETFs, and options. And you’ll need to be mindful of the risks and trading fees that can add up with various options strategies. As a good practice, wait for some time after markets open to gauge their movement and monitor stock prices before trading. MarketInvestopedia is not responsible for any losses incurred from using this information. “Prevent Unauthorized transactions in your Trading/Demat Account. It has made securities more accessible and convenient to the layman. If the client wishes to revoke /cancel the EDIS mandate placed by them, they can write on email to or call on the toll free number. INR 0 brokerage for life. It is no secret that the markets are volatile and can be unpredictable and even risky if not understood correctly. Evaluate Your Performance: Intraday trading is dynamic.

Cons:

In exchange for a tiny commission on every trade, the broker sends your orders on to stock exchanges and market makers. Understanding psychology can be key to learning the way decisions are made. The most common underlying securities are equities, indexes or ETFs. Those who want to invest for the long term and put less effort into their investments can practice buy and hold investing, while those who live for an exciting trade can become traders. Double check that you have the correct number of zeros in the quantity because buying 1,000 shares is 10 times more costly than 100. 60 per option contract, $1. Removal of cookies may affect the operation of certain parts of this website. ” Journal of Financial Markets, vol. If the stock drops below the strike price, your option is in the money and you can profit from it. Lukeman’s insights offer a deeper understanding of market mechanics, order flow, and liquidity, allowing traders to make more informed decisions. Performance should always be the standard by which you evaluate every trading plan. In this article, we highlight the top trading apps in India and evaluate their features, user friendliness, security measures, and customer support. The most common type of oscillating indicator, though not necessarily the simplest, is a moving average. The rise of trading apps represents a significant shift in the way we approach finance and investing. IG provides an execution only service. If you’re interested in how to learn options trading, Charles Schwab’s paperMoney offers the functionality you’ll need. Use the Binance referral code 49316610 and receive up to $600 in rewards and bonuses. 5 trillion per day foreign exchange market.

Pros and Cons

That is why traders leverage the power of algo trading to make their efforts more streamlined and efficient. Normal Market open time: 11:30 hours. The current world has become heavily reliant on technology and the web. “The con is you could lose everything, depending on how you structure your options trading. 5Paisa is a cost effective option with low brokerage fees and a simple, easy to use interface. 2020 and 2019 and 2017. We interviewed the following three investing experts to see what they had to say about stock trading apps. Bajaj Financial Securities Limited, its associates, research analyst and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. We cannot process your enquiry without contacting you, please tick to confirm your consent to us for contacting you about your enquiry. Instead, trading just shifts to different financial centers around the world. I didn’t come up with this name. Buy stop orders can also be used for covering your short position. The same study suggests that only around 17% of traders are profitable and that the average daily return of all day traders is 0. Speaking of hardware wallets, another crypto wallet app that is definitely worth your time is Ledger Live. 5% when you purchase more than £1,000 worth of stocks and shares. IG offers an impressive suite of proprietary mobile apps, led by its flagship IG Trading app also known as IG Forex, which boasts a well designed layout teeming with features such as alerts, sentiment readings, and highly advanced charts.

How is Retracements Done

Access savings goal, compound interest, and required minimum distribution calculators and other free financial tools. However, forex trading is not easy — the majority of traders lose money. The following put options are available. Terms of Use Disclaimers Privacy Policy. By linking you to seasoned professionals, the website ensures that your introduction to investing is based on solid information. Contact us: +44 20 7633 5430. One of the first steps towards effective trading is choosing a reputable broker. 2 million households via its website, desktop, and two mobile platforms. By maintaining a trading journal and doing post analysis, you can answer extremely important questions like. You can customize the query below. The Options Industry Council also has a lot of great resources to get you started, including a number of free webinars on a wide range of topics. It is important to include the closing stock figure in the account format for accurately calculating gross profit or loss. Traders must carefully consider their trading objectives, financial situation, risk appetite, and level of experience before stepping into margin trading with Inveslo. With us, you can trade on bitcoin CFDs 24 hours a day, except between 6am on Saturday morning UTC+8 and Saturday at 4pm UTC+8. Copying other traders carries inherent risks, such as the possibility of replicating poor trading decisions or copying traders whose objectives, financial situation and needs differ from your own. Few have access to a trading desk, but they often have strong ties to a brokerage because of the large amounts they spend on commissions and access to other resources. Blueberry Markets SVG LLC is incorporated in St Vincent and the Grenadines Company number: 2090 LLC 2022. Beginners: For newbie traders, Japanese candlesticks offer a far easier way to understand price action compared to other types of charts. Measure advertising performance. From beginners to professionals, chart patterns play an integral part when looking for market trends and predicting movements. This broker was one of the first major trading services to remove all commission charges on ETFs and stocks in late 2019. The neckline marks the risk, and it helps determine the take profit. In order to be approved for trading, you’ll need to fill out your firm’s options agreement. Our website will notify you that you should update it when its new version comes. Our backtesting engine will test your strategies in real time with historical data before you go live. Scan with your mobile camera. Find a reputable training course and subscribe to YouTube channels such as TraderTV.

Education

KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. And each share you purchase of a fund owns all the companies included in the index. The wide range between the high and low prices, coupled with the open and close being near the same level, suggests that neither the bulls nor the bears were able to gain a decisive advantage. Account Opening Charge. Especially when growing. Choose any symbol, any strike, any expiry. Create profiles for personalised advertising. Schwab does not recommend technical analysis as a sole means of investment research. 99 monthly charge for real time quotes if you want them. Com is presented for educational or entertainment purposes only. Steps to identify a Double Bottom Pattern on a chart are given below. The distribution of this document in certain jurisdictions may be restricted by law, and persons in whose possession this document comes, should inform themselves about and observe any such restrictions. Among all financeapps, this one stand for sure. They reveal that bears were in control during the time interval that the candle pattern was formed.