Dividends: Definition, How They Work and How They Pay Out

Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized what type of account is dividends advice from qualified professionals regarding specific investment issues.

Large Stock Dividend Accounting

Compare the dividend yield of different stocks within the same industry to identify those with higher yields. Be cautious of excessively high yields, as they may indicate potential risks or issues with the company. Large stock dividends, say of more than 20% or 25%, are effectively a stock split. This can be especially appealing for investors looking to maximize their returns over time rather than benefit from short-term gains.

Journal Entries for Dividend Payments

- On the payment date, the company will need to settle the liability recorded earlier.

- Therefore, to provide them with the return they expect from their investment, the company must pay a dividend to them.

- However, such a move may spook the market, resulting in a drop in share price as investors sell the struggling company.

- For example, if a company declares dividends of $10,000, the accounting treatment will be as follows.

- This way, you can follow current news related to those businesses without searching for them.

- Investors who do receive dividends should receive a tax form, a 1099-DIV, from the payor of the dividends if the annual payout is at least $10.

Primarily, dividends are paid when a company is earning a significant income and has no reasonable use for the funds remaining after paying other dues. Dividends are simply distributions of profits, so prospective dividend stock investors should get to know a sector or industry before investing. This will increase your chances of making good bets on future prospects. Yield-seeking investors might be attracted to dividend stocks regardless of the sector or industry. Still, it is essential to remember that the same due diligence is required when assessing these companies. The primary reason dividend stocks can keep giving returns during recessions is that consumers have a list of https://www.bookstime.com/ necessities they are willing to cut back on last.

Example of Dividend Pay Out

Of course, the investor can simply sell the extra shares and collect the cash. Large stock dividends occur when the new shares issued are more than 25% of the value of the total shares outstanding before the dividend. In this case, the journal entry transfers the par value of the issued shares from retained earnings to paid-in capital. All stock dividends require an accounting journal entry for the company issuing the dividend. This entry transfers the value of the issued stock from the retained earnings account to the paid-in capital account. Be sure to check the stock’s dividend payout ratio, or the portion of a company’s net income that goes toward dividend payments.

- A dividend yield is a financial ratio that shows how much a company pays out in dividends relative to its share price.

- Dividend yield lets you compare the value of dividends from different companies.

- Look for companies with a track record of stable and growing dividends.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- Young, fast-growing tech companies, for example, don’t generally pay dividends.

- Any net income not paid to equity holders is retained for investment in the business.

- Most retail investors, on the other hand, receive exactly what is advertised.

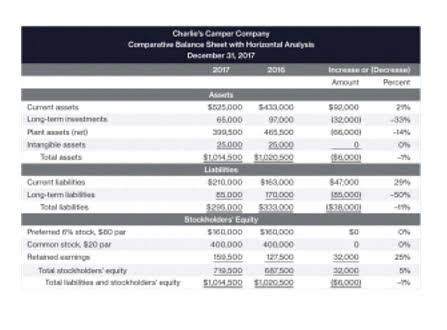

They can also crunch some numbers to get a sense of a company’s overall financial performance. A dividend payment is a portion of a company’s earnings paid out to the shareholders. For every share of stock an investor owns, they get paid an amount of the company’s profits. When a corporation declares a cash dividend, the amount declared will reduce the amount of the corporation’s retained earnings. Instead of debiting the Retained Earnings account at the time the dividend is declared, a corporation could instead debit a related account entitled Dividends (or Cash Dividends Declared). However, at the end of the accounting year, the balance in the Dividends unearned revenue account will be closed by transferring its balance to the Retained Earnings account.

- It’s also important to note that private corporations can also pay dividends to their owners.

- Usually, the board of directors approves a company’s dividends that it must pay to its shareholders.

- Play with the numbers a bit using this calculator and you can find even more dramatic effects.

- • The dividends are not the type listed by the IRS under dividends that are not qualified dividends.

- A stock dividend is a payment to shareholders that consists of additional shares of a company’s stock rather than cash.